What to expect from Momentum Life Cover

Momentum’s life cover insurance, both it’s Myriad and Longevity options are fairly broad based in that they are containers that offer great personal flexibility all depending on your own financial needs and life stage. They also understand that you need to be covered from when you say you need cover – not when your first premium is paid. That’s why they offer free life cover from acceptance of cover until you pay your first premium. Great guys – Viva Momentum!

Want some help with the right life cover options?

Please give me a call and tailor make a life cover package for me – I’m not like everyone else!

This is what Clientele Life Cover Pays Out

Clientele is a life cover company that understand its clientele! It knows that we are all just a little bit different and has produced policies that are unique for each one of us. Not only do they offer awesome cash back schemes, but they provide life cover of up to several millions, all depending on your life stage.

Want some help with the right life cover options?

Please give me a call and tailor make a life cover package for me – I’m a little different to the next guy…

Assupol life cover payout details

So what exactly do you get from Assupol when buy life cover from them? Life cover policies from Assupol are based on your individual criteria – that would be how old you are, how many children you have and also how much you would like to be covered for.

A 45 year old male with 2 children has a different profile to a 32 year old with a mountain bike – and I’m guessing that your own needs are different too!

Want some help with the right life cover options?

Please give me a call and tailor make a life cover package for me.

Liberty Life, so much more than just a Policy

The length and breath of Liberty Life Group extends to more than just life policies. The immediate reaction to the overwhelming amount of information out there can leave you with a vague picture of what this life insurance company offers. However, LifeCompare provides a concise brief about Liberty Life policies and what how to get life insurance quotes.

Just like any other life policy, the first consideration you make depends largely on other life policy quotes that have found. With this information at hand, you can proceed to choose an insurer to cover you. Your Liberty Life policy will detail everything you need to know with regard to your policy and the insurer. Detailed with be your monthly premium contribution, and how this amount should be debited to Liberty Life. Here you can choose various payment options. Also, there will be details on what will happen should you miss any one payment. This is very important as just one missed payment could leave you unisured.

A really great Liberty Life Cover perk, is that they will pay you back 5 months premiums every 5 years! That sounds like a policy benefit worth having!

Besides the above mentioned, other important details will be contained in your policy. The duration of your life policy will be explained. The total amount of your cover, and what type of insurance you have taken. That’s the basic life cover which makes up the foundation of a Liberty Life policy. The second thing is to build on that foundation, where there are details about your funeral policy and amount allocated thereof. If you have taken up income and credit insurance, these too will be detailed. Another important type of offering that Liberty has are dread disease and disability insurance. These can be separate policies, but in general they are grouped all in one.

Now that you know enough about Liberty Life policies, it’s advisable to learn about other life insurers. There are definitely differences between the various policies the have, and as mentioned above, it’s better to know too much than to know too little when buying life insurance.

Liberty Life Contact Details

0860 327 327

www.liberty.co.za

Information About Assupol Policies

Over 100 years – that’s how long Assupol policy issuances have landed on South Africans’ hands. This life insurance company has really stood the test of time, thus, by having it as your life insurance partner, you’re really in it for the long run. Its stability will leave you to take care of the important things in life, like taking care of your family.

Assupol South Africa

An Assupol policy can be one or a combination of these following –

Progress Accident Plan

For R73 a month, you can get up to R1 million of life cover from Assupol. However, with this policy you do not get funeral cover for your spouse or parents, so you will have to take up a top-up policy to cover your extended family. Also, with the Progress Accident Plan, you do not get a cash back of your premiums.

Progress 4Sure Plan

The current premiums on this policy are R90 per month, however, you get additional benefits to the previous plan. These additional benefits include funeral cover for your spouse, and an additional increase on your retirement if it is already with Assupol Insurance.

Progress Legacy Plan

With other insurers, getting cover of up to R10 million could require you to pay in excess of R500 a month in life premiums, however when you have a Progress Legacy Assupol policy, your premiums start at R150 per month. That’s a great deal! Furthermore, the benefits included in the policy are worth the premiums. You get funeral cover for yourself and spouse, and increases in your retirement fund. For a little addition to your premiums, you can also get disability and terminal illness insurance, a bond cover, and an education fund that will go to your schooling children should you pass away.

Assupol Contact Details

0860 103 091

www.assupol.co.za

Do You Need a Momentum Policy?

A Momentum policy provides you with a comprehensive solution to your life insurance needs. Your life policy with Momentum Insurance is there to safe-guard you against life’s risks and what those risks pose to your loved ones. Here, we explain the two life insurance options that can make up your Momentum policy.

Firstly, Momentum offers its basic life cover insurance, Life Cover Provider. With this, you get an industry beating life insurance option. By taking out this policy, you will essentially benefit from Momentum’s many other products like free financial advice. With the Life Cover Provider, you can get up to R3-million as a lump-sum payout when you die.

The second product is Myriad. This Momentum policy aims to cater to your lifestyle adjustments while you are alive. This means that if you stay alive longer, you can enjoy more of the many benefits that Momentum has. A good example is the Longevity programme. In this, you are paid back some of your life insurance premiums in cash for your life’s milestones. This goes well to encourage a healthier and more balanced lifestyle, thus avoiding the many complications that come with growing older.

In summery, Momentum’s second life policy offers you – standard life policy cover which includes life insurance, critical illness and disability insurance, impairment benefits, a future insurability benefit, and a retirement savings booster.

With both policies, you qualify for payout when you suffer a critical illness. This also means that Momentum’s disability insurance cover comes standard with your policy. Furthermore, depending on your risk profile and the record of your payments, you can qualify to get paid a portion of your lump sum amount if you have reached the age of 80 years without ever making a claim.

Momentum Life Policy Contact Details

www.momentum.co.za

0860 665 432

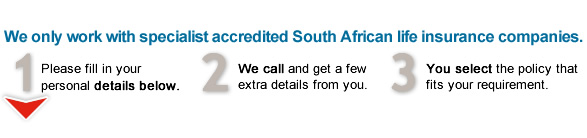

Get Life Policy Quotes Online from us

Well done on doing something proactive about looking after your dependants future when you are gone. Being responsible and taking care of those that love you and need you is a great step in the right direction. Let’s see what the various life insurance policies have to offer, not all are the same and seeing that you as an individual have different needs from life, your policy should cater for these needs.

Below are some common features that life policies might include, we have turned them into easy to read icons and will include them if a company offers this service as part of their life policy. This should simplify the process of getting a life policy quote online.

Medical Benefit

Funeral Plan

Disability Plan

Debt Relief

Cash Back